SportCaller’s MD talks to G3 Newswire about how understanding Covid-influenced behaviour and the use of analytics have been key to 2020’s marketing successes

The online gambling industry is in transition, not just in terms of business models, distribution platforms and products, but how those products are promoted and marketed. Cillian Barry explains why understanding Covid-influenced consumer behaviour, release timing and analytics are key to successfully marketing free-to-play games.

How has Covid-19 changed and influenced consumer behaviour?

Potential systemic changes to consumer behaviour were always the burning issue with this pandemic. Where were the short-term spikes (for example, poker or virtual sports), and which trends would prove catalytic in accelerating the way the industry was already evolving (e.g. the move towards digitized entertainment). Speaking generally across the industry, where a raft of Q3 results have now been reported, and we can see a reversion to type, with products like poker declining rapidly in the face of a rise from casino and a massive rebound from sport, premised on pent-up demand.

However, what Covid-19 did expose was how ill-prepared many operators were to cope with a sudden disruption to BAU. Pushing sports betting players into casino games and more obscure sports, like table tennis, was not a good look and the industry rightly took some flack in the media. Consequently, curbs were imposed by various jurisdictions to protect players.

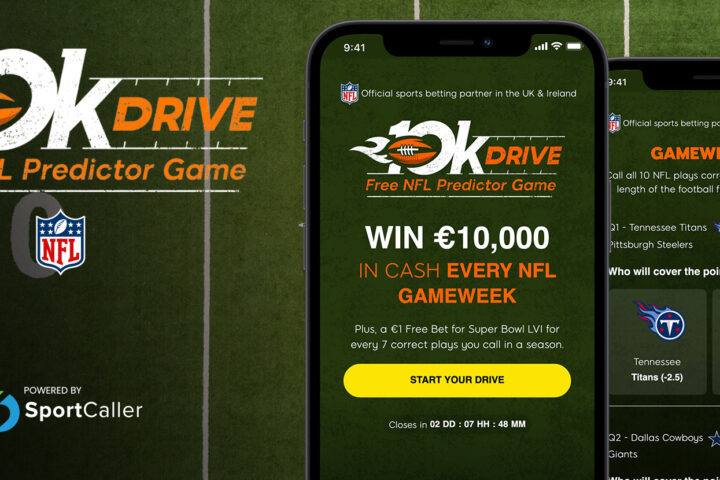

All of this accelerated the growing importance of FTP to the industry. Our games allowed our clients to offer a soft, and responsible, means of keeping players engaged with their core products of interest. As a result, it should come as no surprise that most of our current games with leading operators in mature European markets are aimed at player retention in a sustainable and responsible way. This should become another enduring and positive legacy effect from Covid-19 for both consumer protection and education.

From a free-to-play perspective, what is the best strategy to reach consumers? How do you effectively market FTP games?

External marketing of our games, of course, lies with our individual clients. However, this is not to say that we do not provide a valuable service in terms of approach which will naturally speak directly to the remit of any given marketing team.

We are very clear that FTP games are only as successful as the traffic that is driven to them. As for our specific suite of games, we know that 70%+ of all visitors will complete a game entry and an average of 87% of those that register a new account will do likewise.

Leveraging our experience across hundreds of games and dozens of clients and countries we are well-placed to advise on the strategy, and at the heart of this sits the desired outcome from running the game – acquisition, retention, re-activation, cross-sell, or otherwise requested. This is the first question we ask when talking to new clients. The answer accordingly informs and ensures that best practices are hard-wired in the command centre of all our game mechanics.

SportCaller works with clients in the UK, Europe, Asia, Australia, LatAm and North America. How does your marketing approach change depend on both the market and client, and where are you seeing the most growth?

The only real differential is whether the desired game outcome is retention or acquisition. Again, our focused strategy, ideation and broad data from a host of worldwide partners give SportCaller a competitive edge when it goes to advisory services.

After all, SportCaller offers nearly 100 games across 47 countries and in 20 languages (via multilingual API) in Europe, Asia, Africa, Australasia and North and Latin America. And in the last year, we’ve rolled out around 50 new games, more than doubling the total number offered over the past three years, with similar two-fold increase in its active and ongoing operator partnerships.

Unsurprisingly, there is a focus on acquisition and lowering CPAs in the US, while in UK and Europe FTP is being used to improve retention and increase customer value. In all regions, we are seeing positive signs with cross-sell from casino and poker into sports betting through our games.

What are the main challenges for operators moving into the free-to-play space? To what extent should operators adapt their marketing strategies and business models to maximise the impact of FTP games?

As alluded to above, operators need to have a clear strategy and expected outcomes for offering FTP games. These should be defined at the outset, measured meticulously and continuously, and flexibly adapted to optimise ROI. We are also seeing many operators wanting to innovate in this area but being limited by internal resource, so they need to turn to external suppliers.

A great case study for this is Paddy Power Betfair’s Beat The Drop, an award-winning product which we’ve been running for the client since the 2018 World Cup. In the two-plus years since the product was launched, there has been a continuous, and busy, roadmap which has evolved thanks to agile collaboration. The core product remains the same, but the delivery and promotional mechanics have progressed and improved based on ongoing detailed analysis.

We’re proud to say that the product is now a leading retention tool for Paddy Power in local markets and a go-to-market acquisition tool for Betfair internationally (including a recent roll-out across almost all Latin America countries).

How should distinct game formats, such as predictions and quizzes, be marketed differently?

It’s not so much how they are marketed but how they are pressed into service by the client. Predictions are the core of our business and, given their organic proximity to gambling markets, that will always remain the case. It is that sense of enhancing the enjoyment of watching sport, or indeed any event, that appeals to audiences. Plus, in the USA, this also fulfils the very important role of educating audiences that are entirely new to the world of sports betting.

Quizzes, on the other hand, are more of a light-touch engagement tool, something you might play on the way to work or use as a platform on which to compete with friends or colleagues for bragging rights. These tailored offerings allow operators to keep players engaged with a brand in a fun and socially-responsible manner and will often be used at times during the week, or the season, when a customer may not want to have a bet but still would like to be entertained.

In terms of future growth, we see both formats as a synergistic solution for sports leagues and teams, increasing dwell-time on apps and maximising eyeballs on their products.

Is there less of an onus marketing FTP games to find a balance between marketing and enticement? Do FTP games offer operators an opportunity to market themselves in a more expressive way?

They certainly do, FTP is a much softer and responsible way to target players, both new and existing, than traditional means such as bonusing or enhanced prices. FTP is compliant across all jurisdictions and in all states in the US, allowing operators to acquire and engage prior to legislation.

They also facilitate flexibility in targeting specific events or promoting new betting markets without the player having to invest any of their own cash. Indeed, an eloquent recent case in point, set against the backdrop where it’s illegal to bet on politics in the US, saw us launch two different game types with FanDuel that allowed them to target a new and distinct demographic across every state with fun prediction games on the debates and the election itself.

One of the more difficult factors concerning free-to-play cited by operators is balancing a return on investment with marketing budget, whilst definitions of ‘retention’ and ‘acquisition’ vary between different companies and products. What are the KPIs for FTP? Is there a right or wrong? For example, should acquisition be defined as a sign-up or an active player?

This is a great question, and one where we aim to take the lead with our clients. As previously stated, we look to establish the key goals for each game and use our knowledge and experience to advise on the most efficient and effective methodology for each game journey.

That goes to determine the KPIs on each game which, of course, have to be aligned with client-reporting. However, we do aim to help define what a FTP player is. As an example, for acquisition purposes, we would suggest that this should be determined by a player’s first action after registering – if the player bets then plays our game, we don’t get the attribution on that player.

Ultimately, there would be no longevity to our games, or our business, without a positive return for the client. So, it’s vital for us to help the client understand the value that each game brings and drives. As a result, the KPIs are always defined by conversion, especially if the end goal for acquisition is a new depositing customer.

For retention-focused games, this is somewhat less the case, as FTP becomes increasingly important in terms of keeping a player engaged with your brand and minimising churn. It therefore becomes as much a product designed to offer an enhanced experience for active players as it is a driver of bets from them.

Are data points being logged and measured correctly? Should there be a uniform industry-wide measurement, or does it ultimately depend on individual operator strategy?

As discussed, we do aim to guide on this – and, as the FTP market-leaders, enjoy a good vantage point from which do so. However, ultimately it must be the client that determines what success looks like.

We do offer standardised reporting on our platform, which doesn’t touch on client reporting but allows them to get a proper sense for the performance of each game. This measures weekly players, weekly new players, week-on-week returning players, returning players for each of the past three or four weeks, clicks on upsell prompts and total lifetime unique players. This is available to all clients, regardless of the levels of integration, as all the data is stored on our side.

In October, SportCaller launched Free Or 4 with William Hill. How significant is release timing with FTP games?

It is less around calendarized release dates and more so around the lead-in time for major events and the frequency of ongoing games.

For a major event like next summer’s rescheduled Euros, it’s important to release in good time to allow the base to build – but, just as importantly, to garner the data points on players to allow for highly personalised comms, both in the run-up to and during that event.

For ongoing games, it’s all about habit-formation. Players should know when to expect the game to go live, when it usually closes and how quickly it will settle after the event. We find that games which adhere to strong principles around reliable timeframes will become a gateway to the client site, whereby the FTP game acts as a means of defining thought-processes around real-money bets.

Longer term, how important is having a content roll-out plan with operators? For example, have you already begun work on Free or 4’s successor?

I can’t speak to individual operator plans, but I can say that we already have a detailed roadmap for 2021 with all our major clients, while the pipeline has never looked busier for new clients. This involves improvements on existing games, and new-game plans around specific events, all ably abetted by collaborative discussion around innovative ideation to foster progressive game-types.